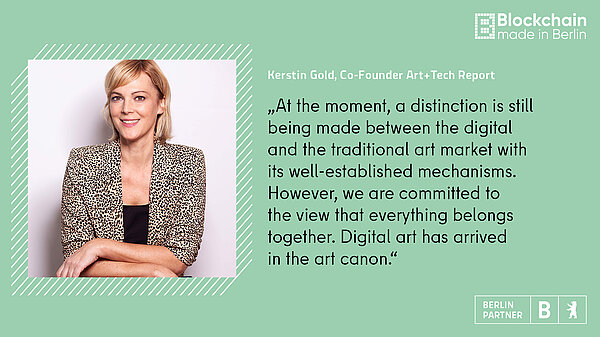

Combining NFTs with digital art was one of the promises of the crypto boom in recent years. Videos such as „Crossroads“ by digital artist Beeple, the digital timer „Clock“ by Murat Pak or the gif „A Coin for the Ferryman“ by xcopy were highly traded and are among the most expensive art NFTs. The most popular currencies: Ethereum, Tezos, Solana. What is the current state of the art market and NFTs? Does NFT art have a future? It's not just market observers and Web3 enthusiasts who are asking themselves this after the cryptocurrencies crashed in the winter of 2022/2023. Collections that were originally highly traded are struggling with a loss in value. Leaving the hype aside for a moment and taking an interest in the actual developments that digital art is undergoing, there is no getting around the "3. Art + Tech Report – Digital Art Coll3cting". This was published by the four Berliners Kerstin Gold (strategy consultant), Anne Schwanz (gallery owner), Johanna Neuschaeffner (gallery owner) and Kristina Leipold (Managing Director of the LAS Art Foundation). They interviewed around 300 international art collectors and NFT art collectors in the summer of 2023 and offer a good insight into their personal experiences and preferences.

The 1st Art + Tech Report (published in 2021) was born out of the desire to open up the more traditional and less tech-savvy art market. It picked up on the dynamics of the general surge in digitalization and the increase in online art purchases due to the pandemic. As there is little data and quantitative surveys on this, the editors themselves began to create an empirical data basis by anonymously surveying over 380 international art collectors. With the 2nd Art + Tech Report (2022), the buying behavior and collector motivation of art NFT collectors was examined in order to identify important market opportunities and make recommendations to sellers in the digital art market. The 3rd Art + Tech Report is far more niche. It asks how blockchain technology influences market mechanisms in the art market and how digital art collectors and artists operate. What characterizes them and how do they work? What aspects of art are important to them? The result is a qualitative survey that is not representative, but reveals trends and provides a guide in a rapidly changing art market.

Many beliefs about what works or doesn't work in the art industry are shaped by the sales side. But developments do not stop at the art market.

Art NFTs have come to stay - this is also reflected in the mood of the report. For 83% of respondents, digital art is on a par with traditional art forms such as sculpture or painting. Thanks to blockchain technology, which makes it possible to secure image files so that they cannot be duplicated and ownership can be traced, art can be clearly assigned and owned. Suddenly there is a technological infrastructure for this art form and the possibility of owning "something digital". Until now, videos and graphics have been sent and reused without the file being assigned to a specific property. Ownership is the actual basic motivation for collectors on the art market.

Who are the collectors?

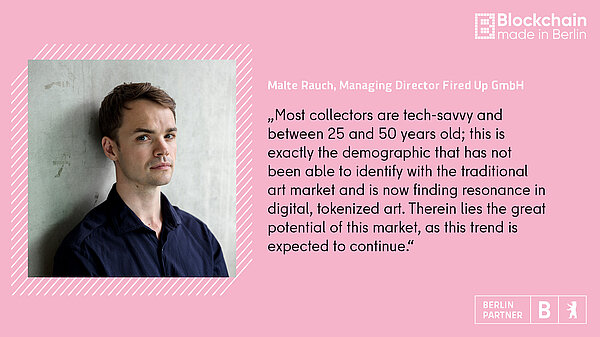

After evaluating and talking about the Art+Tech report, Kerstin Gold sees several groups - "and not just among crypto nerds", as she emphasizes. There are the tech natives, mostly younger and often from the financially strong start-up scene. And there are also collectors who are interested in contemporary art regardless of their age group and like to buy art online. Crypto-savvy people who have come to digital art with the NFT boom are a group that has not been well represented in the art industry to date. They previously traded in collectibles, for example, and are now starting to get excited about physical objects as well as crypto art. What they all have in common is their enthusiasm for art. In addition to his work at Fired Up, Malte Rauch advises the glitch Gallery, a project incubated by Collab+Currency, as well as other companies and funds in the field of crypto and digital art.

According to the Art+Tech Report survey, generative art (55 percent), blockchain-based art (48 percent), digital paintings (32 percent) and AI art (30 percent) are of particular interest to collectors. The majority of collectors spend up to 1,000 dollars on them - a relatively low investment amount in the art industry. And it's not just financially that the inhibition threshold is lower: getting in touch with artists on platforms or looking around is much easier than ringing the doorbell of a backyard gallery on a Saturday afternoon. Interested parties can take their first steps on the digital art market unobserved.

While the NFT market is still strongly male-dominated, the report also shows that the proportion of women among collectors has increased, particularly in the last year. They also appear to be less influenced by the crypto crash and are more strongly represented in the traditional art market. Overall, however, the majority of respondents also stated that they continue to invest in their collections after the crypto market crash and around half do not see the value of their collections affected by it. Whereas at the beginning of the NFT hype, crypto-savvy people were said to be content with owning art in their wallet, there is an increasing desire to display digital art in analog form. When asked how they generally like to show or exhibit their digital art, 79% said they would show it on their smartphone, but only 32% in their wallet, while more than one in two would like to exhibit it in a digital setting at home, on a screen or as a physical reproduction in print - a "phygital art experience".

New ways for artists

Crypto art also means that artists can act much more autonomously. A lower production budget is required on the web3. Easier self-marketing means that intermediaries are no longer required for contact with collectors. Digital platforms also allow new players to establish themselves on the market. In addition to OpenSea and objkt, fx(hash) - an online marketplace founded in Berlin - is among the top 3 platforms offering digital art. As an open platform, fx(hash) aims to revolutionize the world of generative art by providing a secure, intuitive platform for artists, collectors and curators, using multi-blockchain technology to ensure that artists can unleash and share their digital creations worldwide blockchain-agnostically with increased reach. Paul Schmidt, fx(hash) COO explains: "Our ethos when we started was: open for everyone, no curation. We maintain that, but now we allow galleries, DAOs and individuals to use our platform as curators and work directly with artists.

We also attach great importance to global parity, for example by working with Volume DAO from Taiwan." fx(hash) relies on the blockchain currency Tez. "Generative art is a global art phenomenon, so as a platform we have to build on blockchains that allow global participation. So we need a cheap and fast blockchain without expensive gas fees," says Schmidt.

The artist Volatile Moods, who is represented on fx(hash), makes the following statement in an article when asked about her presence there: "It is important to have more information about a particular work in order to be able to evaluate it properly. The community plays an important role in recognizing such works. In terms of visual impact, I see no problem with works that contain simple or poorly written code, as long as the results are original and aesthetically interesting. At the end of the day, code is just a medium." And for Jason Baily, founder of ClubNFT and editor of the blog Artnome.com, it makes art more diverse: "Allowing anyone to launch their drops when they want and as often as they want, without curation or censorship, makes for fascinating and unpredictable art."

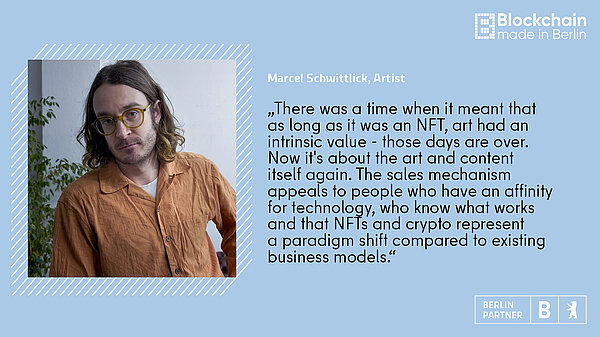

Marcel Schwittlick is an artist from Berlin who explored generative aesthetics at an early stage. He describes his approach as performative. He works on installations, luminograms and plotter drawings in a studio in Schöneweide. He writes the software for his works himself and designs the hardware. He says: "I work with galleries, but not permanently. I like to be independent and autonomous. I avoid exclusivity." For him, NFTs are the means to an end, certificates of ownership for works of art. He does not face a mass of collectors, but is usually in contact with a few people who collect expensive works. This community already existed before NFT became a topic. But he also sees the barrier to entry as lower thanks to NFTs. Previously, there was no way of earning money with this type of art; it was seen purely as a hobby. For him, the administrative work involved in communication and organization is part of it. The crypto crash is of little relevance to his work.

He also believes that a market is emerging for a certain type of art that could not be capitalized on before. His works can soon be seen in a group exhibition at the DAM Gallery in Berlin-Charlottenburg or at Art Dubai.

Galleries and communities: who decides on the market?

65% of respondents to the Art+Tech report stated that direct contact with artists is one of the greatest benefits of NFT art, followed by 38% who value ownership as a member of an exclusive community. Communities influence more than half of collectors' purchasing decisions and are the most important source of information after social media but before NFT platforms. They are very close via Twitter or Discord and a relationship develops - an almost closed system in which collectors and artists interact in a digital space. This is where careers are launched, demand is driven forward and attention is drawn to follow-up projects. Communities are effectively becoming the fourth player in the market alongside artists, collectors and galleries. Conversely, artists must invest heavily in these communities and interact with them, offer them exclusive information or seek contact in real life via an exclusive event.

Nevertheless, galleries are not a dying model. Without it, artists would often be faced with a large administrative apparatus and without curation as collectors, an unregulated oversupply of digital images. This can also create excessive demands: Which art should be invested in? Who are the artists behind it? Which platforms are safe and where are the risks? There is still a need for pre-selection, selection, curation and guidance. Almost half of those surveyed in the Art+Tech Report stated that more curation and contextualization could motivate them to buy digital art. 40 percent would like to see it included in museum collections.

What happens after the hype?

So what does the art market look like after the hype and what can you do if you want to get in? The Art+Tech Report survey shows that 71% say they want to continue and increase their investment in NFT art, and to a greater extent than last year. The enthusiasm among those who are already there is unbroken. There is a loyal community of collectors growing up here who, together with the artists, now have the opportunity to shape this ecosystem around NFT art. The concept of collecting is shifting. "NFTs in general and digital art in particular are collected for very different motivations. With digital art, the focus is clearly on the artistic concept; the "utility" is primarily the art itself," says Kerstin Gold. Blockchain is becoming the new creative medium here, paving the way for new art forms such as generative art or AI art. The authors of the Art + Tech Report predict that Web3 technology will bring more transparency, accessibility and diversity to the art market. Malte Rauch says: "I think a distinction should be made here between non-fungible tokens (NFTs) as a technology that could be used in many applications and the specific use case of art.

Whether NFTs will be used on a broad front, as many have claimed in 2021, is still completely open in my opinion and depends above all on the extent to which this form of tokenization in apps offers added value for consumers. In the specific use case of art, it has already been proven that there is traction and sustainable growth. The market capitalization is 10 billion and the technology has several advantages over the traditional art market, from transparency and anti-counterfeiting to an improved liquidity profile."

Kerstin Gold has the following tips for those who want to get started: Look around on the relevant platforms and discover artists and works that interest you personally. Initial contacts with artists can then be made directly via Twitter and Discord. You should use the social media structures and follow other collectors as well as artists, who often provide insights into their collections in this way or draw attention to exciting projects at an early stage. Newsletters have established themselves as a good source of inspiration; we recommend Fanny Lakoubay from New York or the Swiss Georg Bak, for example. If you follow these channels, you will be able to develop your own taste and opinion. Malte Rauch says: "Personally, I am particularly interested in generative art, AI art and artists who explore blockchain as a medium in its own right. For me, the German artist Kim Asendorf is one of the best generative artists. He develops dynamic systems in which the interplay of order and chaos is balanced. And the anonymous Studio Mathcastles artists, entrepreneurs, collectors and investors. The best way to keep up to date with art is definitely X (formerly Twitter) and specialized sites like RightClickSave and Outland Art. The special thing about this still young scene is that many of the best artists and most interesting entrepreneurs are very approachable and you can enter into a direct exchange with many of them."

Last but not least, as with online shopping, security is a major issue. More elaborate quality anchors or pre-curation are needed here. But the barrier to entry for art NFTs is lower compared to the traditional art market and the market is more transparent.

SOURCES:

Interviews:

- Kerstin Gold, Strategist and author of the Art+Tech Report, https://www.arttechreport.com/

- Paul Schmidt, COO, fx(hash): https://www.fxhash.xyz/

- Marcel Schwittlick, artist: https://schwittlick.net/

- Malte Rauch, Fired Up GmbH, collector and curator, https://www.linkedin.com/in/malte-rauch-260b2b22a/

Articles:

- Art+Tech Report 2023: https://www.arttechreport.com/

- „The Emergent Artists of fx(hash): https://www.rightclicksave.com/article/the-emergent-artists-of-fx-hash-interview-generative-art

- „Kunst-NFT: Wie es funktioniert und was es für die Kreativbranche bedeutet“ (Art NFT: How it works and what it means for the creative industry"): https://99designs.de/blog/news-trends/nft-kunst/